Innovating Vehicle Sales NOW

Authors: Anand Srinivasan, Ken Bara

Crises aren’t new but they always serve as accelerants for industries ripe for transformation. Automotive OEMs must use this opportunity to innovate at the dealer level – or face being left in their own dust.

Crisis Breeds Innovation

Major economic slowdowns are invariably marked with organizations, big and small, having to deal with diminished customer demand and falling revenues with no near-term relief in sight. Many are unable to withstand such unrelenting financial hardship and go out of business. These major economic slowdowns also commonly result in appearance of innovative players that radically alter the status quo that existed prior to the crisis. These innovative players identify and rapidly capitalize on opportunities for innovation that become available in the highly unusual market conditions of a slowdown. The opportunities in question may not always be a previously unidentified service or product that people need in times of distress. They could also be an innovative way to deliver the same service or product in a cost-effective and more consumer-friendly way.

For example, when the SARS epidemic hit China in 2003, the then nascent Alibaba (4 years old, 400 employees, less than $500M in valuation) faced an existential crisis. As one of their employees got infected with the virus, CEO Jack Ma sent the entire workforce home with their desktop computers to try and service customers as best possible while trying to keep the company afloat. In parallel, a small group of developers and executives holed up in Ma’s own apartment gave birth to Taobao, Alibaba’s response to eBay. Afraid to venture out during the pandemic, the Chinese population turned to the internet in large numbers to order the things they’d normally buy from stores. Taobao grew rapidly by offering innovative incentives such as allowing sellers to list goods on the website free for three years, something unheard of before in e-commerce. eBay was forced to shut shop in China in 2006, less than 3 years after Taobao’s debut. Today Alibaba is a $480 billion company that employs over 100,000 people.

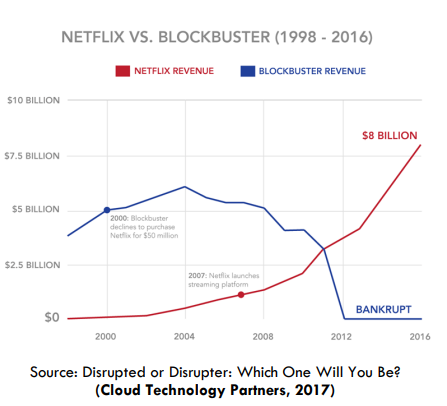

The event that paralyzed the global economy unlike anything since the 1930s Great Depression was the Global Financial Crisis of 2008 which ultimately led to a protracted recession that took the world the better part of a decade to fully recover from. Despite giants such as Lehman Brothers and Washington Mutual being wiped out of existence (with others such as AIG coming to the brink), certain other companies came roaring through the recession with better fortunes than any of their competitors. One such company was Netflix. Renting DVDs was not an unknown service before. Blockbuster, Redbox did it before Netflix existed. However, in 2009, Netflix offered consumers unlimited DVD rentals with no late fees and unlimited access to their online streaming video library at a price of $9 a month. Compared to paying $10 to $20 to buy a DVD or paying $5 to rent one from Blockbuster, consumers still reeling from the after-effects of the economic downturn found it easy to make the choice. Netflix saw a 5% earnings growth worth $83 million while Blockbuster posted a $374 million operating loss with sales down by 5% in the same year. What Reed Hastings realized was, people are willing to pay a small amount for entertainment despite economic hardships – as long as they saw the value in what was being offered.

While these times of crisis sparked changes and innovation across all industries, some of the biggest impacts were seen in the automotive industry.

Vehicle Sales Ripe For Disruption

The automotive purchase experience has been undergoing transformation in the last decade. Light vehicle sales have been slowly declining since 2015 (17.6M units sold). In Feb 2019, IHS Markit forecasted this decline to continue into 2021, with a baseline sales prediction of 16.5M units and a pessimistic sales prediction of 14.5M units; factoring in effects of COVID-19 on the economy may push that prediction even lower. Dealerships have seen a steady trend of higher staff turnover, fewer visitors and declining profits (7% drop from 2016 to 2018) in recent years. How do automotive OEMs go about fixing what is very clearly a suboptimal retail process that leaves consumers, dealers and the OEMs alike increasingly dissatisfied? One school of thought is that OEMs should pursue a strategy of vertical integration, taking over most (if not all) of their dealership outlets, thereby exerting complete control over the customer purchase experience. Another school of thought is that rather than risking the enormous capital it would take to run their own dealerships (over $10M to set up a single dealership + $5M/year to operate one), OEMs would benefit far more by adapting to the radically altered shopping habits of their customers today and channel significant resources toward improving the customer’s online shopping experience (on both OEM and dealership portals).

Owing to the vastly increased interaction of consumers with e-commerce giants such as Amazon and Alibaba, consumer expectations of highly informed yet speedy shopping have spilled over into their views about buying larger-ticket items like cars. Evidence suggests that car-buyers have already translated their retail e-commerce experience into their car buying decisions. A 2018 survey by Boston Consulting Group found 95% of shoppers spending 4+ hours gathering information online before ever visiting a dealership. The same survey also noted the dealer visits per sale decline from 4 to 1.4 over the past decade. Both these metrics are a sign of the diminished importance that shoppers place in physical visits to dealerships. As activities upstream in purchase funnel move increasingly online, OEMs have a golden opportunity to interact directly with their end users. By improving the online car browsing/buying experience, OEMs can collect data about the make, model and features that a buyer prefers and use that information to ensure that the buyer’s preferred model is on their nearest dealer’s lot before they go in for a test drive, significantly improving the probability of making a sale. The high turnover and low engagement in sales staff at dealerships tends to negatively impact the customer experience, another downside that can be significantly mitigated by enticing the customer to spend more time online, and less time on the dealer lot. As with the fashion and real estate industry, automakers need to invest in technologies that allow shoppers to experiment with colors and features online and virtually get into the driver’s seat, potentially even test-driving cars without leaving the comfort of their homes. For their most digitally savvy customers, OEMs could employ an omni-channel sales strategy where the shopper after carefully making their selection, places the final order online and only visits the dealer to pick up (rather drive off) the merchandise; Target has employed this strategy in retail since 2017 with their curbside Drive Up service to spectacular effect in terms of both popularity and bottom-line. Automakers should also experiment with innovative sales methods such as the automated car-vending machine pioneered by Carvana, potentially giving shoppers a completely contact-less purchase option.

The COVID-19 situation has restricted physical access to dealerships by consumers unlike any situation in modern history and will force shoppers to turn for their auto-buying needs to the internet and other contact-less modes at an unprecedented scale. As with past economic upheavals, organizations that make the right moves to exploit these new opportunities stand to reap outsized rewards, grabbing significant market share from their more complacent competitors.

Sources:

https://www.harpercollins.com/9780062413406/alibaba/

https://hbr.org/2010/03/roaring-out-of-recession

https://www.business2community.com/finance/5-businesses-survived-recession-01137706

https://www.impactbnd.com/blog/not-all-is-lost-some-businesses-are-thriving-during-covid-19

https://www.automotiveworld.com/articles/why-oems-should-fix-not-abandon-the-dealership-experience/

https://www.autonews.com/nada/auto-dealers-losing-money-operations-nada-says

https://www.bcg.com/publications/2018/new-way-to-sell-cars.aspx

https://www.cargroup.org/wp-content/uploads/2019/02/Wall.pdf

https://www.cloudtp.com/doppler/disrupted-or-disrupter-which-one-will-you-be/

Harsh Chaturvedi, Data Scientist at Microsoft, was a special contributor to this article.

More Publications

-

Automotive Innovation Series, Part 4: Harnessing Unsupervised Machine Learning in the Automotive Sector

-

The Future of Payment Infrastructure: Overcoming Challenges & Embracing Innovation

-

The Current State of the Financial Services Industry: Key Challenges & Priorities for the Future

-

The Current State of Credit Unions: Challenges, Trends, and Solutions for Sustainable Growth